In 2016, Dhofar Insurance Company embarked on its business transformation journey with the Board of Directors, led by the Chairman Majid Al Toky, effecting leadership restructuring and devising the new growth trajectory. The strategic change has paid rich dividends for the company over the years with the insurance major notching up yet another outstanding financial performance in 2020.

Remarkable Financial Performance

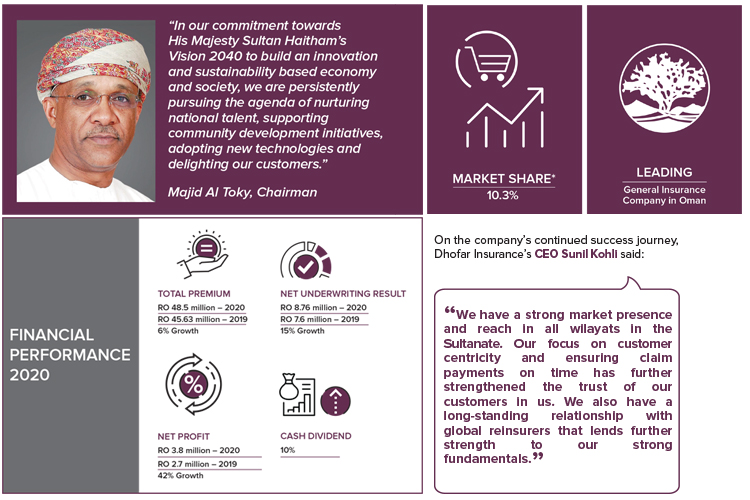

Dhofar Insurance reported excellent operational results in 2020 underpinned by robust business growth, despite a very challenging economic environment. The company has recorded a total premium of RO 48.5 million in 2020 compared to RO 45.63 million in 2019, leading to a growth of 6 per cent. The company has further consolidated its position as the leading general insurance provider in the Sultanate.

Dhofar Insurance’s net profit has increased significantly to RO 3.8 million in 2020 compared to RO 2.7 million in 2019, registering a whopping 42 per cent growth. The company’s Board of Directors has declared 10 per cent as cash dividend aggregating to RO 1 million. The company has also received regulatory and shareholder approval to redeem the funds raised from major shareholders over the next five years.

Talking about the company’s extraordinary performance especially under a very challenging pandemic impacted environment, Majid Al Toky said, “It is our constant endeavour to proactively adapt to transforming regulatory landscape, technology shift and consumer requirements. As leaders in the insurance business and in our commitment towards His Majesty Sultan Haitham’s Vision 2040 to build an innovation and sustainability based economy and society, we are persistently pursuing the agenda of nurturing national talent, supporting community development initiatives, adopting new technologies and delighting our customers.”

Strategic Growth Initiatives

In the recent times, Dhofar Insurance has developed new products and introduced new delivery mechanisms to serve customer needs more effectively. The company has introduced various digital channels that enables a customer to have an insurance policy issued from the comfort of their home or office or on the move. In addition, the company has launched the facility of issuance of vehicle registration cards at select locations, enabling the customer to complete all insurance and vehicle registration at the same location, thereby providing value added services to its customers at their convenience. The newly launched ‘mobile accidental damage’ product has also been well received in the market.

On the company’s continued success journey, Dhofar Insurance’s CEO Sunil Kohli said:

“We have a strong market presence and reach in all wilayats in the Sultanate. Our focus on customer centricity and ensuring claim payments on time has further strengthened the trust of our customers in us. We also have a long-standing relationship with global reinsurers that lends further strength to our strong fundamentals.”